Summary: Standard deductions for 2015 US tax returns are available as a tax benefit and are determined by filing status.

|

| "Taxes ahead -- road sign"; yellow-colored traffic signs serve as general warnings: 401(K) 2012 (401(K) 2012), CC BY SA 2.0 Generic, via Flickr, CC BY SA 2.0 Generic, via Flickr |

Taxpayers who are required to file US federal income tax returns may be eligible to claim the tax benefit of a standard deduction on their return.

Taxpayers enter their total income into the income section of the form. The total income is reduced to adjusted gross income (AGI) by allowable deductions, such as alimony, moving expenses, or student loan interest, which are subtracted from total income.

After determining the adjust gross income (AGI), taxpayers may be eligible to select, between two choices, the more favorable option as a tax benefit for further reducing, or even for eliminating, the amount of income subject to taxation: itemized deductions; or standard deduction.

Taxpayers are allowed to select the option that has the larger tally and that, therefore, leads to a lower tax. If, for example, the standard deduction yields a higher tally, the taxpayer should select that option.

Standard deduction for 2015 for most taxpayers:

The standard deduction for 2015 federal returns, which is listed below and also is presented in a table, is determined by filing status.

For Single or Married Filing Separately, the standard deduction amounts to $6,300.

For Married Filing Jointly or for Qualifying Widow(er) with Dependent Child, the standard deduction amounts to $12,600.

For Head of Household, the standard deduction amounts to $9,250.

| Filing Status | Standard Deduction |

| Head of Household | $9,250 |

| Married Filing Jointly | $12,600 |

| Married Filing Separately | $6,300 |

| Qualifying Widow(er) with Dependent Child | $12,600 |

| Single | $6,300 |

Exceptions for standard deduction:

Three exceptions for the standard deduction exist.

Exception 1 applies if the taxpayer -- and/or spouse if filing jointly -- may be claimed as a dependent on another person's tax return. For this exception, the dependent taxpayer determines the standard deduction by using the Standard Deduction Worksheet for Dependents.

Exception 2 applies if the taxpayer -- and/or spouse, if applicable -- has a birthdate before Jan. 2, 1951, or is blind.

|

| standard deduction for dependents, Form 1040 instructions 2015, page 39: Department of the Treasury Internal Revenue Service, via IRS |

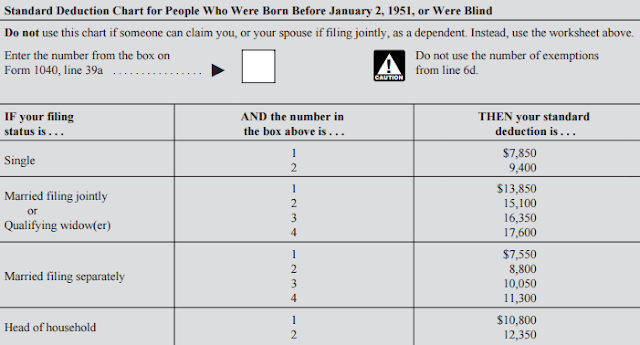

Exception 2 applies if the taxpayer -- and/or spouse, if applicable -- has a birthdate before Jan. 2, 1951, or is blind.

For this exception, the taxpayer computes the standard deduction by referring to the Standard Deduction Chart for People Who Were Born Before Jan. 2, 1951, or Were Blind.

Exception 3 applies if: (a) the taxpayer's spouse itemizes deductions on a separate return; or (b) during the tax year, the taxpayer was a dual-status alien, i.e., both nonresident alien and resident alien within same tax year.

|

| standard deductions for people born before Jan. 2, 1951, or were blind, Form 1040 instructions 2015, page 40: Department of the Treasury Internal Revenue Service, via IRS |

Exception 3 applies if: (a) the taxpayer's spouse itemizes deductions on a separate return; or (b) during the tax year, the taxpayer was a dual-status alien, i.e., both nonresident alien and resident alien within same tax year.

For this exception, the standard deduction is $0.00 (zero), even if the taxpayer is blind or has a birthdate before Jan. 2, 1951.

Standard deduction: beneficial alternative to itemization

Taxpayers who arrive at the line for inputing the amount of itemized deductions or of the standard deduction are entering the sections pertaining to taxes and credits on the US federal income tax return.

Both options offer the tax benefit of reducing the adjusted gross income (AGI) from which taxable income is determined. It is up to the taxpayer to select the option that offers the larger tally.

An attractive aspect of the standard deduction is its easy availability, requiring few computations and no record keeping, for those taxpayers whom it favors.

|

| Standard deductions for most taxpayers are listed under "Standard deduction for" to the left of line 40, 2015 Form 1040, page 2: Department of the Treasury Internal Revenue Service, via IRS |

Acknowledgment

My special thanks to talented artists and photographers/concerned organizations who make their fine images available on the internet.

Image credits:

Image credits:

"Taxes ahead -- road sign"; yellow-colored traffic signs serve as general warnings: 401(K) 2012 (401(K) 2012), CC BY SA 2.0 Generic, via Flickr @ https://www.flickr.com/photos/68751915@N05/6869765923/

standard deduction for dependents, Form 1040 instructions 2015, page 39: Department of the Treasury Internal Revenue Service, via IRS @ https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

standard deductions for people born before Jan. 2, 1951, or were blind, Form 1040 instructions 2015, page 40: Department of the Treasury Internal Revenue Service, via IRS @ https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

standard deductions for most taxpayers, 2015 Form 1040, page 2: Department of the Treasury Internal Revenue Service, via IRS @ https://www.irs.gov/pub/irs-pdf/f1040.pdf

For further information:

For further information:

Marriner, Derdriu. "Standard Deduction Exceptions for 2015 US Federal Income Tax Returns." Earth and Space News. Sunday, Jan. 31, 2016.

Available @ https://earth-and-space-news.blogspot.com/2015/03/standard-deduction-exceptions-for-2015.html

Available @ https://earth-and-space-news.blogspot.com/2015/03/standard-deduction-exceptions-for-2015.html

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.