Summary: EDGAR is a telepresence robot for webcams but Nadine is an emotionally intelligent humanoid robot and Nanyang Technological University's new receptionist.

|

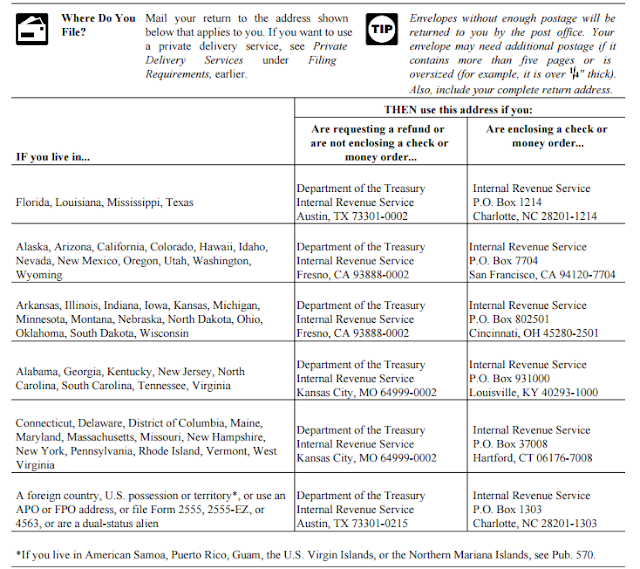

| NTU @NTUsg via Twitter tweet of Dec. 29, 2015 |

Comfortable eye contact, flowing brown hair and soft-skinned hand shakes are the hallmarks of Nadine, an emotionally intelligent humanoid robot, according to announcements Dec. 29, 2015, from Nanyang Technological University in Singapore.

A robot becomes an emotionally intelligent humanoid on the order of C-3PO of Star Wars books and films by cultivating personality, displaying moods and expressing emotions. The emotionally intelligent humanoid robot conveys mental and social savviness by giving good first impressions of maintaining eye contact, offering professional smiles and perfecting hand shakes. Nadia Thalmann, Institute for Media Innovation director and School of Computer Engineering professor, designates Nanyang Technological University’s emotionally intelligent humanoid robot by the name of Nadine.

Nadine exists because of Professor Nadia Thalmann.

Faculty and staff at Nanyang Technological University in Singapore find superficial resemblances between the director and the robot because Professor Thalmann is the humanoid robot’s creator.

Professor Thalmann gets to monitor Nadine’s strong and weak points since the emotionally intelligent humanoid robot is a new hire as receptionist at Nanyang Technological University. Nadine handles meet-and-greet face and name retentions and conversational gists while adjusting moods to tones and topics through software similar to Apple’s Siri and Microsoft’s Cortana.

Professor Thalmann imagines Nadine ultimately as a “real companion that is always with you and conscious of what is happening” in child and elderly care-giving situations.

EDGAR joins Nadine as another creation from Nanyang Technological University before year-end 2015.

Different agenda activities for his skill set than those of the emotionally intelligent Nadine keep EDGAR remotely controlled as a telepresence robot of Nanyang Technological University.

EDGAR looks not at all like Nadine since a telepresence robot is expected to interact with people through a webcam controllable anywhere in the world. Three years of research and development make EDGAR into a rear projection screen to project a face and two articulated arms to replicate movements in real-time. EDGAR needs articulated arms to mimic upper body movements and to project physical presence and a rear projection screen to display the user’s face and reactions.

Telepresence robots occupy multiple locations simultaneously and offer interactions without actual physical presence.

EDGAR promises to meet multiple needs beyond conferencing, according to Gerald Seet, BeingThere Centre researcher and School of Mechanical and Aerospace Engineering at Nanyang Technological University.

The technological improvements that make his appearance and mobility virtually plausible on computer and television screens qualify EDGAR for acting out scripts and for delivering speeches.

Professor Seet reveals that a telepresence robot such as EDGAR can expect to receive multiple job offers from entrepreneurs in business settings and in educational institutions. He suggests that tourism figures high on the list of industries in which a telepresence robot such as EDGAR can be everywhere and nowhere at all.

Nadine tackles one location since she cannot walk whereas EDGAR tackles many simultaneously.

|

| Professor Nadia Thalmann (left) with her lookalike social robot, Nadine (right): NTU Singapore, credit restriction: for this story only, via EurekAlert! |

Acknowledgment

My special thanks to talented artists and photographers/concerned organizations who make their fine images available on the internet.

Image credits:

Image credits:

"Meet the #future social companions EDGAR and Nadine, the #NTUsg #telepresence @ #socialrobots.": NTU @NTUsg via Twitter tweet of Dec. 29, 2015, @ https://twitter.com/NTUsg/status/681776654214017024

Professor Nadia Thalmann (left) with her lookalike social robot, Nadine (right): NTU (Nanyang Technological University) Singapore, credit restriction: for this story only, via EurekAlert! @ https://www.eurekalert.org/multimedia/pub/105986.php?from=315263

For further information:

For further information:

Faloyin, Dipo. 30 December 2015. “Scientists Have Built a ‘Social’ Robot with a Personality.” Newsweek > Tech & Science.

Available @ http://www.newsweek.com/scientists-develop-social-robot-has-personality-409993

Available @ http://www.newsweek.com/scientists-develop-social-robot-has-personality-409993

Hays, Brooks. 30 December 2015. “New Social Robot Nadine Has a Personality.” UPI > Science News.

Available @ http://www.upi.com/Science_News/2015/12/30/New-social-robot-Nadine-has-a-personality/8201451499326/

Available @ http://www.upi.com/Science_News/2015/12/30/New-social-robot-Nadine-has-a-personality/8201451499326/

Knapton, Sarah. 29 December 2015. “Meet Nadine, the World’s Most Human-like Robot.” The Telegraph > News > Science > Science News.

Available @ http://www.telegraph.co.uk/news/science/science-news/12073587/Meet-Nadine-the-worlds-most-human-like-robot.html

Available @ http://www.telegraph.co.uk/news/science/science-news/12073587/Meet-Nadine-the-worlds-most-human-like-robot.html

ljessica. 29 December 2015. “NTU’s Newest Receptionist Is a Robot with Moods and Emotions.” AsiaOne > News, Science and Tech.

Available @ http://news.asiaone.com/news/science-and-tech/ntus-newest-receptionist-robot-moods-and-emotions

Available @ http://news.asiaone.com/news/science-and-tech/ntus-newest-receptionist-robot-moods-and-emotions

“Nadine: Singapore University Creates Lifelike Robot Modelled to Look Like Her Creator.” MSN > News > ABC News > Dec. 31, 2015.

Available @ http://www.msn.com/en-au/news/world/nadine-singapore-university-creates-lifelike-robot-modelled-to-look-like-her-creator/ar-BBo4Gg8

Available @ http://www.msn.com/en-au/news/world/nadine-singapore-university-creates-lifelike-robot-modelled-to-look-like-her-creator/ar-BBo4Gg8

Nanyang Technological University. 29 December 2015. “NTU Scientists Unveil Social and Telepresence Robots.” EurekAlert! > Public Releases.

Available @ http://www.eurekalert.org/pub_releases/2015-12/ntu-su122915.php

Available @ http://www.eurekalert.org/pub_releases/2015-12/ntu-su122915.php

NewsBeat Social. 30 December 2015. "Meet Nadine: Researchers in Singapore Build Companion Robot." YouTube.

Available @ http://www.youtube.com/watch?v=L-nKvC8RUm4

Available @ http://www.youtube.com/watch?v=L-nKvC8RUm4

NTU @NTUsg. 29 December 2015. "Meet the #future social companions EDGAR and Nadine, the #NTUsg #telepresence @ #socialrobots." Twitter.

Available @ https://twitter.com/NTUsg/status/681776654214017024

Available @ https://twitter.com/NTUsg/status/681776654214017024

Scalise, Joseph. 30 December 2015. “New ‘Social Robot’ Has an Actual Personality.” Science Recorder > Technology > Robotics.

Available @ http://www.sciencerecorder.com/news/2015/12/30/new-social-robot-actual-personality/

Available @ http://www.sciencerecorder.com/news/2015/12/30/new-social-robot-actual-personality/

Shukla, Vikas. 31 December 2015. “Singapore Scientists Develop Nadine, an Emotionally Intelligent Humanoid Robot.” Value Walk > Science.

Available @ http://www.valuewalk.com/2015/12/singapore-scientists-develop-nadine-humanoid-robot/

Available @ http://www.valuewalk.com/2015/12/singapore-scientists-develop-nadine-humanoid-robot/

Tan, Avianne. 31 December 2015. “Human-like Robot ‘Nadine’ Who Has a ‘Personality, Mood and Emotions’ Unveiled in Singapore.” ABC News > Technology.

Available @ http://abcnews.go.com/Technology/human-robot-nadine-personality-mood-emotions-unveiled-singapore/story?id=36032196

Available @ http://abcnews.go.com/Technology/human-robot-nadine-personality-mood-emotions-unveiled-singapore/story?id=36032196